Oasys (whitepaper here) is a blockchain infrastructure built specifically for game developers to create and operate web 3.0 and metaverse gaming ecosystems. The main problems Oasys aims to solve are 1) gas fees and 2) scaling transaction volumes:

-

Gas Fees: Blockchain games face barriers for mass adoption if gamers must pay gas fees, and Oasys aims to transfer the burden of gas fees from the gamers to the game developer.

-

Scaling Transaction Volumes: Oasys plans to develop an infrastructure that is highly scalable and can handle large transaction volumes at instantaneous speeds. Transactions in games are typically much higher than non-gaming protocols and gamers are adverse to long loading times.

There is no layer 1 blockchain infrastructure that we know of that is specifically in the gaming niche. However, layer 1 protocols like Ethereum, Solana, Avalanche, and Algorand all are platforms with prominent blockchain games operating and being actively developed.

On July 7, 2022, Oasys announced that it completed a $20 million seed round from institutions in a private token sale round. The funds from this round will be mainly used for marketing, business development, and hiring. The Oasys token is planning to be available to the public during November 2022.

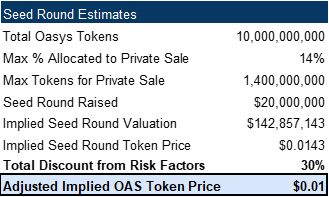

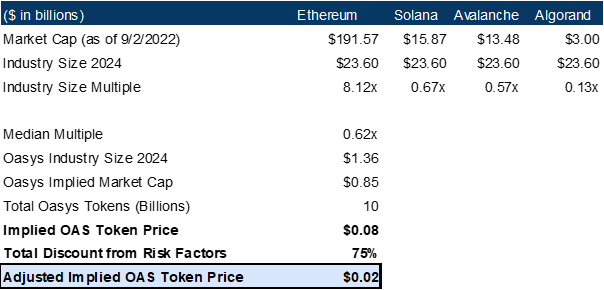

According to its tokenomics, Oasys could have sold up to 14% of its total token supply during the $20 million seed round. 14% of tokens sold for $20 million would yield a market capitalization of $142.9 million, or a token price of $0.0143. We further applied a 30% discount from 3 major risk factors to come up with an illustrative low range valuation of $0.01 per token ($100 million market capitalization). For calculating potential upside, we compared Oasys with its competitors in terms of market cap over industry size and applied a 75% discount from the same 3 major risk factors in the low range valuation. This results in an illustrative high range valuation of $0.02 per coin ($200 million market capitalization). The three major risks factors mentioned are the following:

-

The blockchain gaming industry as a whole does not take off.

-

Oasys does not become a prominent infrastructure for blockchain gaming as there are many existing protocols to build games on.

-

As with any early-stage private company that is pre-product, there is significant risk as limited data is available for retail investors.

Overview of Oasys

Oasys is a blockchain protocol built specifically for the gaming industry. A differentiator of Oasys from other layer 1 blockchain protocols is that the burden of gas fees will be transferred from the gamers to the game developer. Having gamers pay for gas fees is a barrier for mass adoption as gamers will need to go through the hurdle of obtaining tokens to pay gas fees. This will likely prevent some casual gamers from adopting blockchain games as they do not want to go through the hassle of obtaining tokens and setting aside reserves for paying gas fees. Oasys will eliminate this problem by having the game developers pay for the gas fees. Additionally, Oasys aims to have its infrastructure be able to support high volumes of transactions instantaneously, as having to wait for transactions and smart contracts to load is also a factor that negatively impacts the gaming experience.

Oasys was founded in 2022 by veterans in the Japanese gaming industry. Founders include Gabby Dizon (Co-Founder of Yield Guild Games), Hajime Nakatani (President and CEO of Bandai Namco Research), and Shuji Utsumi (Co-COO of Sega Corporation). On July 7, 2022, Oasys announced that it had raised a $20 million seed round from institutional investors including Crypto.com, Jump Crypto, and KuCoin Ventures. At a high level, the $20 million raised will be used for:

-

Hiring additional personnel

-

Marketing and business development

-

Partnerships with game developers and digital asset exchanges

The mainnet launch (when a blockchain product is available for public use) and the initial coin offering is estimated to be in November 2022. It is unclear at this point which exchanges Oasys will be available on.

How it Works

Oasys consists of two “layers”. The first layer, or known as a layer 1, is Ethereum Virtual Machine compatible and adopts a proof of stake (PoS) as the consensus algorithm. The hub layer is scalable and will serve as a central host for all the gaming verses developed on the verse layer. The verse layer is the “layer 2” that will serve as individual ecosystems for gaming studios. Since discussing layer 1 and layer 2 can be confusing to a non-technical investor, let’s go over another example of layer 1 and layer 2. An example of a prominent layer 1 would be Ethereum, which many blockchain developers build on. One of the biggest blockchain games, Axie Infinity, utilizes the Ethereum network. An example of a layer 2 would be Axie Infinity’s own custom wallet, the Ronin Wallet, which handles transactions within its ecosystem at efficient gas prices.

Oasys will allow game developers to build 3 types of fungible tokens / non-fungible tokens for their ecosystems:

-

Restrictive Use Tokens – these tokens can only be minted and used in the verse layer. In other words, they can only be used within a gaming ecosystem

-

Higher Interoperable Tokens – these tokens are minted in the hub layer and can be used across all verse layers. They can also be transferred out of the Oasys network.

-

Minted in External Network Tokens – these are tokens minted outside of the Oasys network and can be transferred into the hub and verse layer of the Oasys network

Oasys aims to become a Decentralized Autonomous Organization (DAO) in December 2028. A DAO, as its name implies, is decentralized due to being governed by the users rather than a centralized management team. The public nature of the blockchain will need users themselves to become validators who essentially run Oasys’ software by validating the blocks on the chain and communicating them to the users in the network. Validators will need to stake 10 million Oasys tokens. Oasys currently has 21 initial validators, which includes big names like Bandai Namco, Ubisoft, and Sega.

Tokenomics

Oasys tokenomics contains 3 levels of tokens. The Oasys (OAS) token will serve the highest level of token. There will also be verse tokens and in-game dApp tokens; each can have specific functions determined by the game developer.

The Oasys tokens will have the following 5 utilities:

-

Payment – this can be micropayment in a game, or for buying NFTs

-

Gas Fees – transactions from verse layer to hub layer, executing a bridge contract, or running a contract on hub layer. Gas fees will increase as transaction volumes increase

-

Staking rewards – in order to become a validator, a user must stake 10 million OAS tokens

-

Governance – token holders can participate in the decision-making process

-

Verse building deposits – a developer must deposit 1 million OAS tokens to build a verse

Initially, there will be a total of 10 billion Oasys tokens. After 6 years, (estimated to be November 2028), token holders will decide whether to allocate additional supply to staking rewards. The current allocation of the tokens are as follows:

Part or all of the 14% should have been allocated during the $20 million seed round funding. In addition, it is noteworthy that a portion of the 38% of tokens allocated to the ecosystem will be used for marketing purposes.

Macro Landscape / Competition

Oasys is a blockchain infrastructure and in many ways will not operate like a traditional business. The value of the Oasys token will increase as the utility of the token increases. For example, as more verses are built, more transactions requiring OAS will occur and gas fees will increase. Each verse builder will also be required to deposit 1 million OAS. Therefore, as Oasys captures more of the gaming market share, the value of its token will increase.

Total addressable market (TAM) for the gaming industry was approximately $200 billion in 2022. What does this mean for Oasys? We must first see what portion of the $200 billion is related to blockchain. The NFT-play-to-earn gaming market was worth $776.9 million in 2021, and expected to grow at a CAGR on 20.4% from 2022-2028. At a CAGR of 20.4%, this implies a TAM of $1.36 billion by 2024 for the blockchain gaming industry.

At $1.36 billion, the blockchain gaming industry will consist of less than 1% of the $200 billion market size of the gaming industry as a whole. If games adopt blockchain at a faster pace than projected, this can be a potential upside for Oasys.

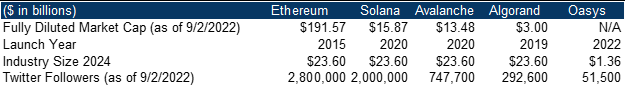

While we currently know no other layer 1 blockchain protocols that targets the gaming industry, many existing layer 1 protocols already host games. These competitors would be Ethereum, Solana, Avalanche, and Algorand. The good news is that many of these platforms already have established token price and market capitalization information that we can use.

Note that these competitors target not just the gaming industry, but the blockchain industry as a whole. The total addressable market for the blockchain industry was approximately $4.9 billion in 2021 and is expected to grow at a CAGR of 68.4% to 2026. This implies a TAM of $23.6 billion by 2024 for the blockchain industry.

Valuation

Illustrative Low Case Estimate

Based on the tokenomics, we can do a back of the envelope calculation on what might’ve been the valuation for the $20 million seed round. If all 14% of the tokens were allocated during this round, this implies a valuation of $142.9 million ($20 million divided by 14%), or a token price of $0.0143. We then take the $0.0143 token price and further apply a total discount of 30% from 3 major risk factors (10% for each risk factor – please see the Risk section for details) to reach a token price of $0.01 and market capitalization of $100 million.

Illustrative High Case Estimate

For our high case scenario, we can potentially measure the potential upside by looking at valuation of competitors. Looking at the market cap of competitors over their industry size can give us an idea of how OAS tokens will potentially perform in the market. For example, Ethereum has a market cap of $191.57 billion (as of 9/2/22), and the projected blockchain industry size in 2024 is $23.6 billion. This implies that Ethereum is trading at an 8.12x multiple of the blockchain industry TAM.

For this illustrative high case estimate, we utilize a median multiple of market cap over industry size of all 4 competitors (Ethereum, Solana, Avalanche, and Algorand) of 0.62x. To apply the 0.62x median multiple to Oasys’ TAM, we will have to use the TAM for the blockchain gaming market of $1.36 billion (as opposed to the TAM of $23.6 billion of its competitors) as Oasys is built specifically for the gaming industry. Using a median multiple of 0.62x and applying a 75% discount from risk factors (25% for each of the 3 major risk factors) yields a hypothetical valuation of $200 million, or $0.02 per token. While this is not a perfect measurement for Oasys as value is derived from utility, in our view it can serve as a benchmark for potential upside during the ICO.

Risks

Valuation is a difficult task for an early stage startup. As such, we have applied a discount to the valuation for each major risk factor we identified for Oasys (as noted in the previous section). For the low case we applied a 10% discount for each major risk factor (totaling 30%) and for the high case we applied a 25% discount for each major risk factor (totaling 75%). The following are the three major risk factors for Oasys that we’ve identified:

-

The gaming industry does not transition into blockchain in a meaningful way. In other words, blockchain will not be a significant part of the gaming industry, and therefore there will be very little use for a blockchain infrastructure that is specifically for gaming.

-

Oasys does not become a significant player in the layer 1 space. Gaming developers may continue to utilize the protocols of existing competitors such as Ethereum, Solana, Avalanche, or Algorand.

-

Like many early-stage private companies that are pre-product, there is limited data available for Oasys. Besides the whitepaper provided, there is not much public information available.

Additionally, potential investors should note that if the seed round valuation was $142.9 million, significant upside has already been priced into Oasys. It’s also worth noting that any macro headwinds for crypto will almost certainly triumph over any project specific factors in the short-term.

Wrapping It Up

Blockchain infrastructure is an interesting space to invest in as it is well positioned to benefit from mass adoption. In addition, many believe that blockchain is the future of the gaming industry. However, one must be cautious with early-stage investments as there are still many unknown factors. As with any early-stage investment, risk is extremely high. Even with a $20 million venture capital investment, it is far from certain that Oasys will ultimately be successful. Generally venture capital firms operate with the business model that many of their investments will fail and the few that succeed will make up for the failed ones. Investors going into Oasys should adopt a similar mindset and have the proper risk tolerance.

Disclaimer: The content presented is for informational purposes only and does not constitute financial, investment, tax, legal, or professional advice. The content is provided ‘as is’ without any representations or warranties, express or implied.